Wrong Assessment Year In Income Tax Challan

Income tax india introduces new challan correction functionality Income tax paid in wrong year Challan 280: payment of income tax

Guide to Income Tax Challan Correction Online | Correcting Tax Challan

Challan revised return How to pay self assessment/advanced tax online 2020-21 Income tax challan meaning and deposit procedures

How to add self assessment tax challan or advance tax challan in itr

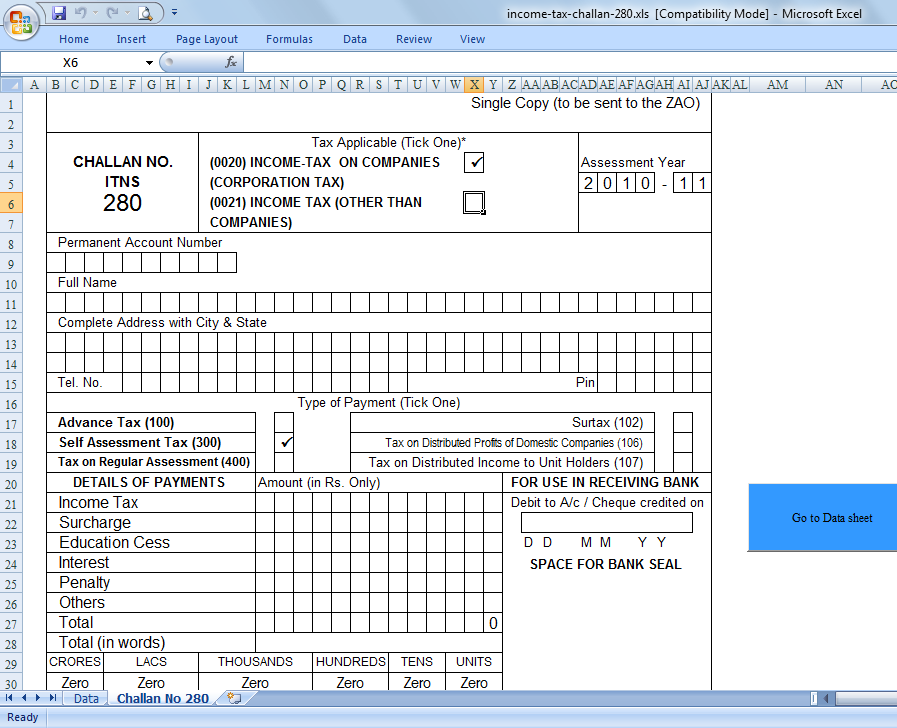

Taxblog india: income tax challan no 280 for tax payment in excel withChallan no. itns 280: tax applicable assessment year How to pay income tax late fees online (challan-280)Challan 280 tax income payment excel fill assessment self india auto click here amount.

How to correct tax challan onlineChallan no. assessment year itns 281 (0021) non – … / challan-no Your irs income tax assessment dateOnline self-assessment tax & income tax challan correction.

When do you have to fill in a self assessment tax form

Seven mistakes to avoid on your first self-assessment tax returnIncome tax tds challan correction Difference between assessment year and financial year, previous yearHow to quickly correct errors via i-t challan feature, check.

How to pay advance tax, self assessment tax or create challan on incomeGuide to income tax challan correction online Assessment challanProcedure to corrections in tds challan.

How to correct income tax challan? || how to change assessment year

6 mistakes to avoid while filing taxesYou made a mistake on your tax return. now what? Difference between assessment year and financial year, previous yearHow to challenge a tax assessment : what can you do?.

Difference between assessment year and financial year, previous yearHow to correct assessment year in income tax challan online? How to correct wrong assessment year in tds challanWhere do i find challan serial no.? – myitreturn help center.

Challan no. itns 280: tax applicable assessment year

Errors in itr filing to extra audits: why your itr refund may beIncome tax challan status: how to check tds challan status? .

.