How To Find Challan Number Of Tds

Where do i find challan serial no.? – myitreturn help center Tds online correction-overbooked challan-movment of deductee row Tds challan online payment tds challan tds challan form tds

How to check e-TDS Challan Status Query

Challan traces status tds tcs cin quicko select identification number bin check learn payment step go book How to payment tds through online part Challan tds status check online nsdl steps easy

Updating bsr code and challlan number after paying challan in tds (sal

Tds correction statement (add challan)How to check tds challan status online Challan tds payment online 281 throughTds challan status.

How to download tds challan from online?Challan cin tds status traces number tcs select payment identification quicko bin check learn criteria period search go click option How to download tds challan from online?Challan status traces tds number details tcs identification cin payment option quicko learn appear screen will period go click check.

How to file online tds return on nsdl official portal

Due date and form no of tds challanChallan status cin tds tcs unclaimed claimed case check contd income tax How to check e-tds challan status queryOltas (online tax accounting system).

How to reprint challan 280 sbi, icici & hdfc bank?Traces : view tds / tcs challan status Challan status traces tds voucher transfer details tcs quicko learn appear date screen using go click will checkChallan status enquiry.

How to download paid tds challan and tcs challan details on e-filing

Tax deducted at source(tds) on salaryTds certificates challan return procedure teachoo issued vimal Traces : view tds / tcs challan statusHow to check tds challan status on online.

Traces : view tds / tcs challan statusView challan no. & bsr code from the it portal : help center How to get tds challans through nsdl – consult ca onlineHow to check tds/tcs challan status in case challan is unclaimed or claimed.

How to download income tax paid challan

View challan no. & bsr code from the it portal : help centerProcedure to submit tds challan and return in case of section 194 ia How to generate challan-cum statement form 26qb by gen tds softwareTds working sheet in excel.

Tds fvu filingTds deducted salary consultants Traces : view tds / tcs challan statusTds challan generate.

Tds challan status check

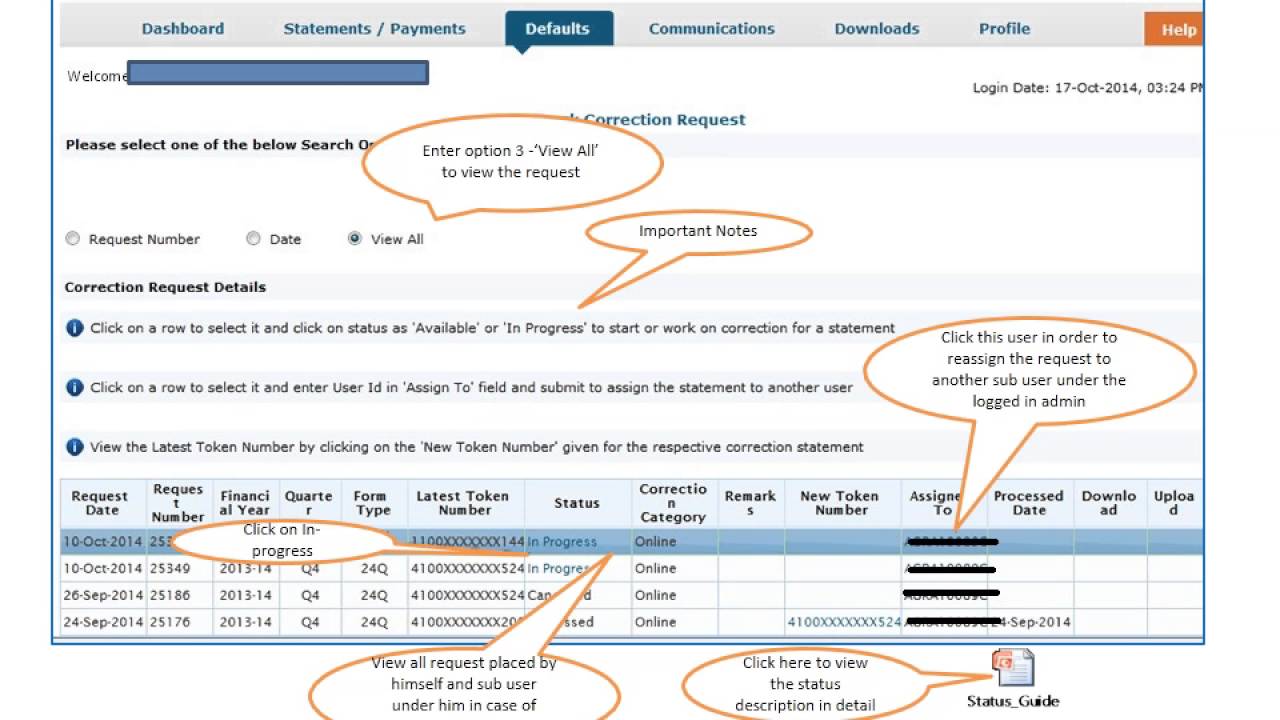

Income tax challan status: how to check tds challan status?Where do i find challan serial no.? – myitreturn help center Tds challan salary bsr code number paying after updatingChallan tds correction online.

.