Fbr Withholding Tax Challan

Tax withholdings Fbr sales tax challan How to generate fbr admitted income tax challan| one click admitted

FBR extends date for filing tax returns up to March 31

Fbr challan Challan fbr Challan 280 in excel fill online printable fillable b

How to file withholding tax statement quarterly through iris in fbr u/s

Fbr income tax returns filing date extended till nov 30How to create advance income tax challan fbr us 147 How to file withholding tax statement 165(1) on iris quarterlyCreating withholding sale tax challan on fbr (2023) step-by-step guide.

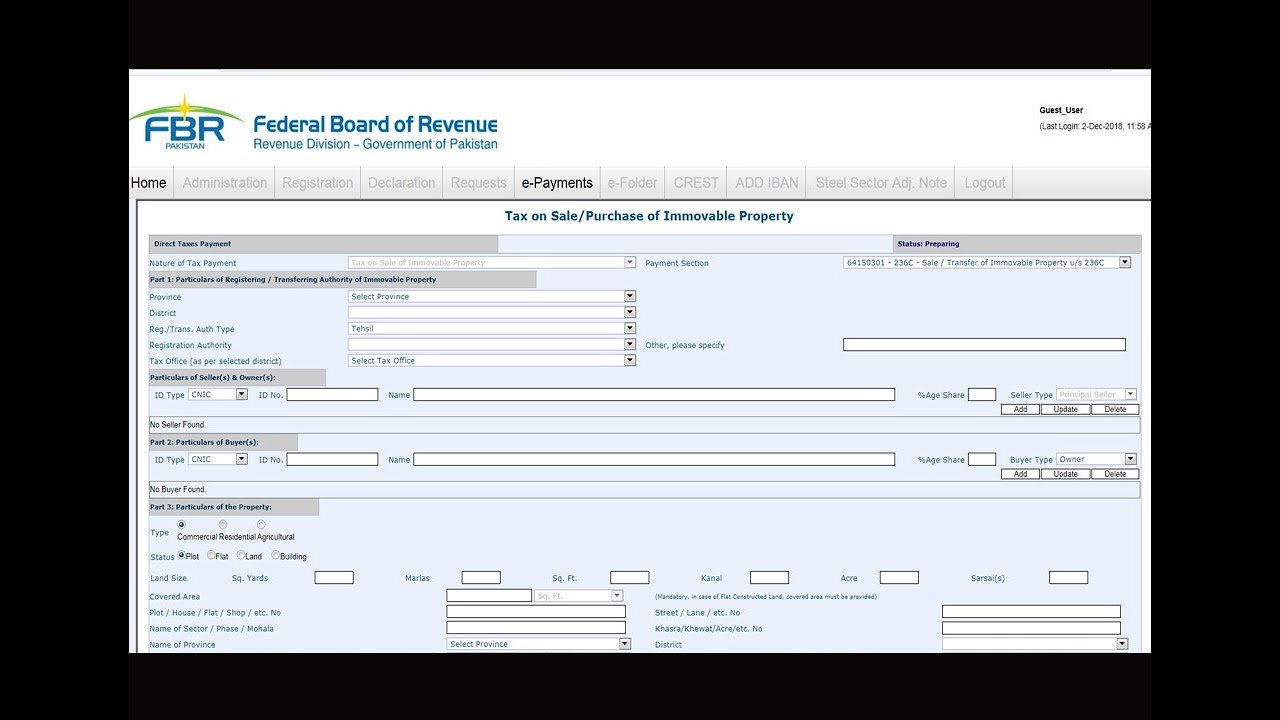

Fbr challan tax property payment transferHow to prepare e-payment to fbr challan for transfer of immovable How to create income tax payment challan in fbr onlineHow to create property tax challan fbr 236k.

How to pay property tax online

Challan 280 in excel fill online printable fillable bHow to apply withholding tax. fbr How to create fbr 236-k tax for purchase of an immovable property inHow to download cpr from fbr.

How to get withholding tax certificateFbr tax property purchase Taxpayers would be required to file a form issued by the fbrHow to create atl surcharge payment challan.

Learn to file withholding tax statement fbr and earn money

How to create fbr admitted income tax e-challan 2023Fbr atl surcharge challan How to generate challan form 7-e fbr tax 2023-24How to create 236c and 236k fbr challan in 2023.

Tax card fbr withholding rate salary income pakistan updated islamabad federal revenue board complete list mostHow to create admitted income tax challan 2022 How to prepare / pay penalty / surcharge challan against late taxOnline coaching school.

Fbr extends date for filing tax returns up to march 31

How to create fbr 236-k tax for purchase a immovable propertyHow to generate fbr wht (withholding tax) challan Fbr withholdingHow to create e-challan for atl surcharge.

Fbr challan.pdfHow to pay admitted tax to fbr || e challan for tax payment || process 153 1b withholding tax on servicesHow to make supplier income tax withholding challan in fbr withholding.